The startup Womply recently brought us Groupon-like "effortless offers." Today it launches Loyalty Cloud, hoping to slice through the messy customer-loyalty market with the "simplest loyalty program ever for local merchants."

Last month a new startup, Womply, launched to bring "effortless offers" schemes to local merchants--coming with an impressive pedigree because it's cofounder Brandt Squires was formerly LivingSocial executive. Just weeks later, Womply has an additional offering--Loyalty Cloud--that promises the same sort of effortless experience but for customer loyalty schemes, rather than Groupon-style "special offers."

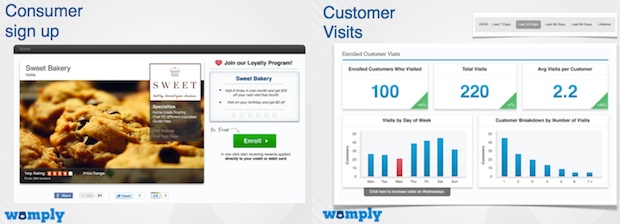

According to the new site, its simplicity rests on the fact that, "Merchants create offers that reward customers for repeat visits and Womply handles everything else, from marketing and remitting offers to customers, to providing analysis and insight on the amount of revenue generated as a result." To this end, Womply's new Loyalty Cloud is trying to be a complete one-stop shop for local business loyalty schemes: Simpler even than stamping a rubber stamp on a collector card, and providing deep customer analytics that would be tricky to get any other way. It manages this by being seamless from a customer and merchant point of view, with the transaction happening "in the cloud" via "Womply's high-tech platform that enables the company to spot credit and debit card transactions at participating merchants and to push cash credits to customer payment cards."

The whole thing is designed to be merchant-centric, rather than focusing on the deals or the end-user customers. Womply itself makes money by charging merchants a low annual rate (in the hundreds of dollars a year range), and it even offers a free entry level. Womply CEO Toby Scammell says that, "From square one we started with this premise that we didn't want to interrupt merchant's operations at all. We think one of the biggest problems, a kind of untold story, from an operational viewpoint with Groupon and LivingSocial there are real costs associated with training your employees, managing the offers in the restaurant or in your bar. We eliminate those completely at the transaction--somebody who's receiving a reward looks identical to someone who's not."

There are other bonuses to this system: Establishments don't have to plan to deal with coupon-toting guests, customers on, say, dates at a restaurant don't look like a cheapskate because their date needn't know they're earning points for the meal, and servers won't worry about reduced tips because the customer is paying a full price, not a discounted one.

"It's a little bit like using a Groupon, but not having to mess around with paper or coupons or mobile devices or anything like that--it's just 'pay with your credit card,'" Scammell says. "We spot the transaction, and if you're eligible for an offer then we push the credit right back to your phone." In effect that's a cash-based equivalent of the kind of tenth-coffee-is-free deal you'll likely have used before.

"We really think that loyalty is the first place that a merchant should start if they're looking to improve and understand their business," Scammell adds, noting that while there are a lot of deal-based systems out there like Groupon and LivingSocial, he and his company "think that they have a place in the ecosystem. But we really don't think that it makes sense to start paying a lot for customers of questionable value until you've understood your current customers and invested sufficiently in them to get them to come back and spend more money when they visit."

It's a question of effectiveness, then. Says Scammell: "50 to 70% of the customers who buy the Groupon, if you're a local merchant, are your customers already--you just don't know that. And it's obviously extremely expensive if you're discounting to your customers at such a heavy rate."

Hence the focus on loyalty schemes, and customer analytics that help merchants understand the people they already please. And to tempt merchants to think this way, Womply's new Loyalty Cloud is incredibly easy to sign up for, from a merchant point of view, and similarly so for customers: Users simply have to visit a merchant-specific front-end webpage, perhaps tempted by a Facebook or Twitter announcement, tap in their details, and give Womply permission to spot if you're using your credit card at the establishment...you don't need to carry a loyalty card, or do anything special other than simply buying the goods as you would do if you're not in the scheme. It's thus platform-agnostic, and customer privacy isn't a problem, as all of the transactional data is already out there--users simply let Womply do a bit of the deal for them.

It all sounds amazingly simple, and its merchant-centric nature and frictionless use reminds us (and the company, Scammell agreed) of the operations of Square, another disruptive tech in the customer transaction market. But there's a big risk here: As payment technologies evolve, Womply risks losing its access to the transaction data from credit card spends. That's not too tricky, Scammell notes. "We think about this every day, trying to skate to where the puck is going to be. The nice thing about the platform we've set up from a data perspective is that we're really form-factor agnostic. So as long as you're paying with a credit card or debit card, whether you're using a 'card not present' transaction online or presenting a physical card, or paying through a mobile device, we can view the transaction." It's a bet that MasterCard, AmEx, Visa, and other big card companies aren't going anywhere soon.

This sounds like the future of customer loyalty, but we're prepared to admit we kinda like the friendliness of toting those loyalty cards around in our wallets, reminding us that we have a free coffee or meal upcoming.

Comments